The Raspberry Pi, that compact and versatile single-board computer beloved by hobbyists, keeps getting more expensive. What was once an affordable entry point into computing now costs over $100 for even the most basic Pi models. For tinkerers on a budget, the rising price of Pis presents a problem. Why have these diminutive boards designed to promote access to technology become so comparatively high-priced? There are several factors at play, from supply chain woes to added capabilities. While more advanced Raspberry Pis justify somewhat higher costs, the core models have certainly lost some of that original budget appeal. Let’s examine the forces behind the increasing Raspberry Pi pricing that keeps many would-be users from taking the plunge.

Executive Summary

Raspberry Pi’s rising prices boil down to increased demand plus supply chain issues. Their low-cost appeal made Pis massively popular, but component shortages and delivery delays have hampered production scaling. More advanced features in new Pi models also raise manufacturing costs. Add in inflation driving up supplier prices, and suddenly, the $35 Pi is double that price. While still useful for learning coding and electronics, Raspberry Pi’s value proposition has unfortunately declined at higher price points. For cost-sensitive buyers, rival single-board computers may offer more affordable options these days. The Pi’s inexpensive magic has eroded somewhat.

Components and Features

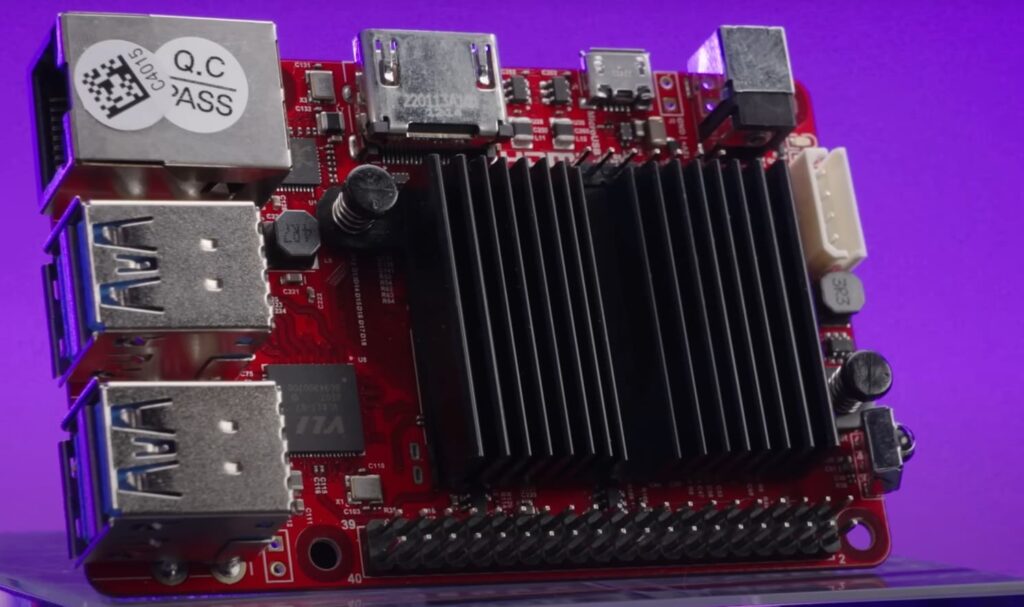

The Raspberry Pi’s hardware capabilities have expanded dramatically since the original models first introduced basic computing at accessible prices. While still compact, modern Pi boards offer performance that rivals desktop PCs and ample connectivity options.

CPU Processing Power

Early Raspberry Pis utilized 700MHz single-core ARM processors, delivering basic functionality but limited speed. Current Pi 4 models feature a 1.5GHz or 1.8GHz quad-core processor based on ARM Cortex-A72 architecture. This provides vastly improved processing power for multitasking, multimedia, and productivity. Pis can now handle typical PC workloads like web browsing, office apps, and 1080p video playback.

Raspberry Pi also offers the Compute Module series based on the same SoCs for specialty uses. These boards integrate the core processor and memory as a standalone component without standard Pi I/O. Compute Modules target industrial applications.

Memory and Storage

The original Model B Pi had only 256MB RAM – insufficient for robust computing. Current Pi 4 variants ship with up to 8GB LPDDR4 RAM to smoothly handle memory-intensive applications. Storage has also expanded from humble microSD cards to now supporting fast NVMe M.2 SSDs up to 2 TB for large apps and datasets.

MicroSD remains the standard boot media, while higher SSD storage capacities enable extensive local data caching for servers and disk-intensive tasks. Raspberry Pi OS has optimized memory allocation to maximize available RAM limits.

Video and Display Interface

Modern Pi boards drive dual displays at resolutions up to 4K via micro HDMI ports, a huge graphics upgrade from early composite video output. The built-in VideoCore VI GPU handles 4K video decoding/encoding in H.265/HEVC along with 3D graphics acceleration. Dual monitor support enables advanced applications like video walls and interactive informational displays.

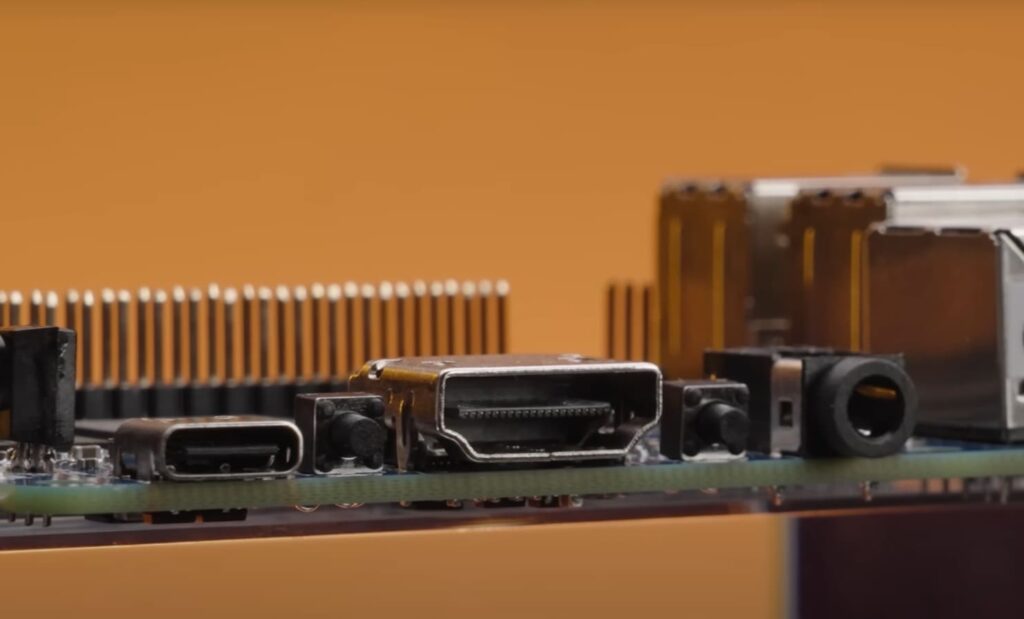

Connectivity and I/O

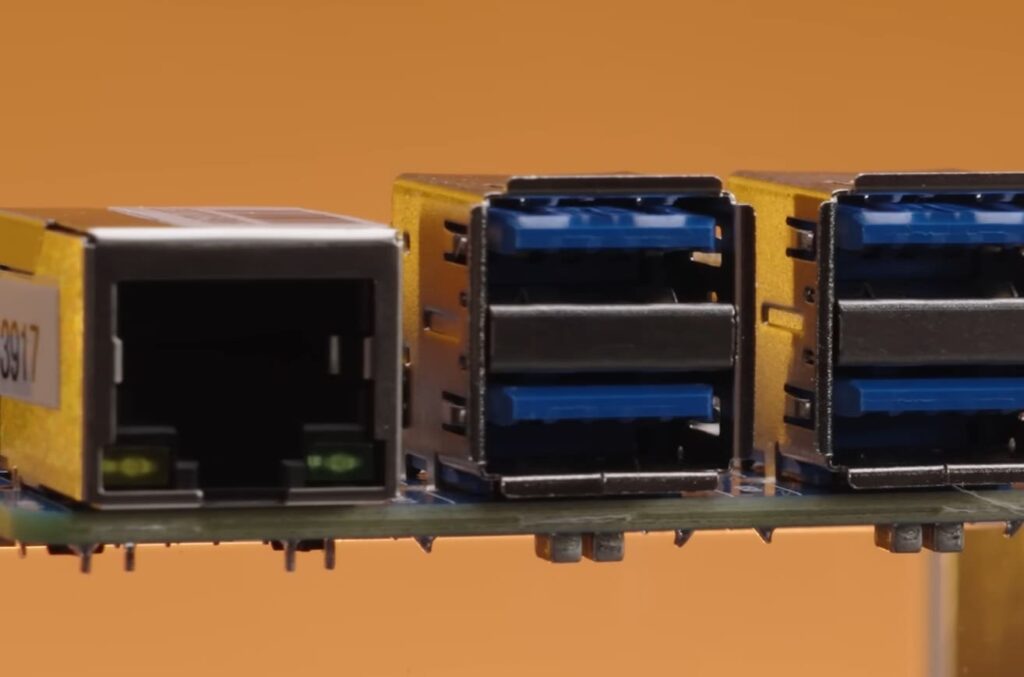

Today’s Pis offer extensive wired and wireless connectivity:

- Gigabit Ethernet

- Dual-band WiFi 5

- Bluetooth 5.0

- Multiple USB 3.0 and USB 2.0 ports

- 40-pin GPIO header for electronics projects

- CSI and DSI ports for Pi camera/display modules

- MicroSD card slot

- HDMI 2.0 video ports

- Audio/composite video jack

- Camera and display interfaces

- Power input

The 40-pin header provides flexible digital I/O capabilities using the bundled GPIO utility. Combined with wireless networking, Pi 4 boards serve as compact yet powerful network servers and IoT devices.

OS and Software

Raspberry Pi packs a huge amount of functionality into its streamlined hardware, partly thanks to optimized software:

- Raspberry Pi OS – Lightweight Linux distribution optimized for Pi resources

- Coder – Program IDE for developing right on Pi

- Wolfram – Mathematical computation software

- LibreOffice – Productivity suite for documents and spreadsheets

- Chromium – Web browser for accessing online apps and services

- Python – Beginner-friendly programming language pre-installed

Raspberry Pi OS forms a capable yet minimalist computing environment. An active community also builds custom Pi-compatible OS images for applications like media centers and smart displays. The included GPIO, Coder, and Python make Pi a versatile platform for programming hardware projects.

While more costly than the original models, Raspberry Pi’s phenomenal expansion of computing power, connectivity, storage, and software over a decade makes the SBC suitable for an incredible range of applications today.

Manufacturing and Distribution

Raspberry Pi has become a global phenomenon, with millions of units produced each year. The manufacturing and distribution pipeline to deliver Pis worldwide contains many cost factors that ultimately influence retail pricing.

Component Sourcing

Raspberry Pi utilizes a host of suppliers, mainly concentrated in China and Taiwan, for sourcing component parts like processors, memory, and various ICs. Direct bulk purchases from component makers like Broadcom enable lower pricing. However, supply shortages since 2020 have driven up costs of chips and other electronic parts. Raspberry Pi indications show BOM costs around $35 currently.

Contract Manufacturers

Raspberry Pi boards are built via electronics manufacturing services (EMS) providers. Large contractors like Flex and RS Components handle PCB assembly and device testing/packaging per Raspberry Pi specifications. Their scale lowers production costs, but labor expenses in China have risen. Manufacturing adds around $5 per Pi, not counting component costs.

Distribution Networks

Finished Pi boards ship primarily by air and sea freight to regional distributors worldwide. Sony handles logistics in Japan, while Premier Farnell and RS Components distribute across Europe and the Americas. Local warehouses supply retailers. Variable fuel and transportation costs contribute to distribution expenses.

Tariffs and Duties

Importing Raspberry Pis incurs tariffs ranging up to 12% in some regions. Recent US trade tariffs on Chinese electronics also impact Pi imports, adding over 15% duties. These taxes get built into the retail price consumers pay. However, Pi’s educational status helps avoid the harshest trade penalties.

Operating Costs

While a nonprofit, the Raspberry Pi Foundation still incurs substantial operating expenses for facilities, staffing, and infrastructure supporting Pi production across 85+ countries. Economies of scale have lowered operating costs as volumes have increased. But wider spending in areas like software development adds overhead.

Profit Margins

As a charity dedicated to affordable computing access, Raspberry Pi operates on thin profit margins – usually 5% or less per unit. Limited margins constrain their ability to absorb rising input costs. However, hardware sales provide sustainability, funding training programs, and further Pi innovation. Increased profits do get reinvested.

Price Elasticity

Raspberry Pi has avoided raising prices too far to prevent significant demand declines. However, growing costs may challenge this strategy. With capable substitutes available, price hikes could motivate some users to adopt lower-cost alternatives, shrinking the Pi community. Keeping pricing accessible remains a priority.

While Raspberry Pi pricing trends higher amidst rising expenses, the nonprofit model helps limit price inflation versus a for-profit company. The foundation actively works to restrain costs and provide maximum value, advancing Pi’s educational mission worldwide.

Competition and Market Demand

Raspberry Pi dominates the low-cost single-board computer (SBC) market but faces increasing competition, which applies pricing pressure. Meanwhile, the incredible demand for Pi drives prices up amid scarce supply.

Rival Boards Emerging

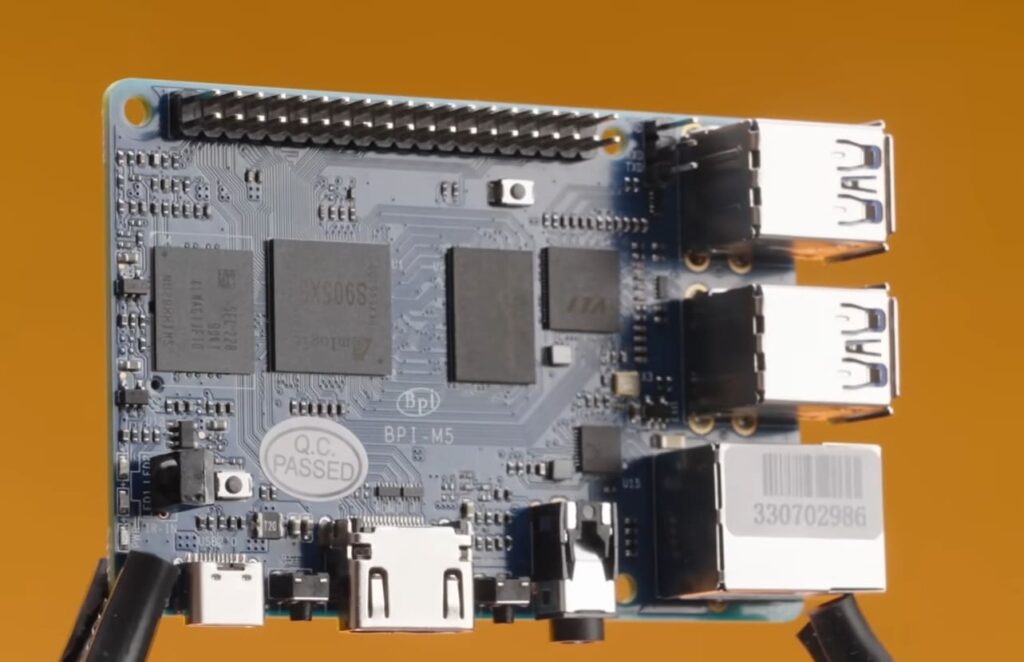

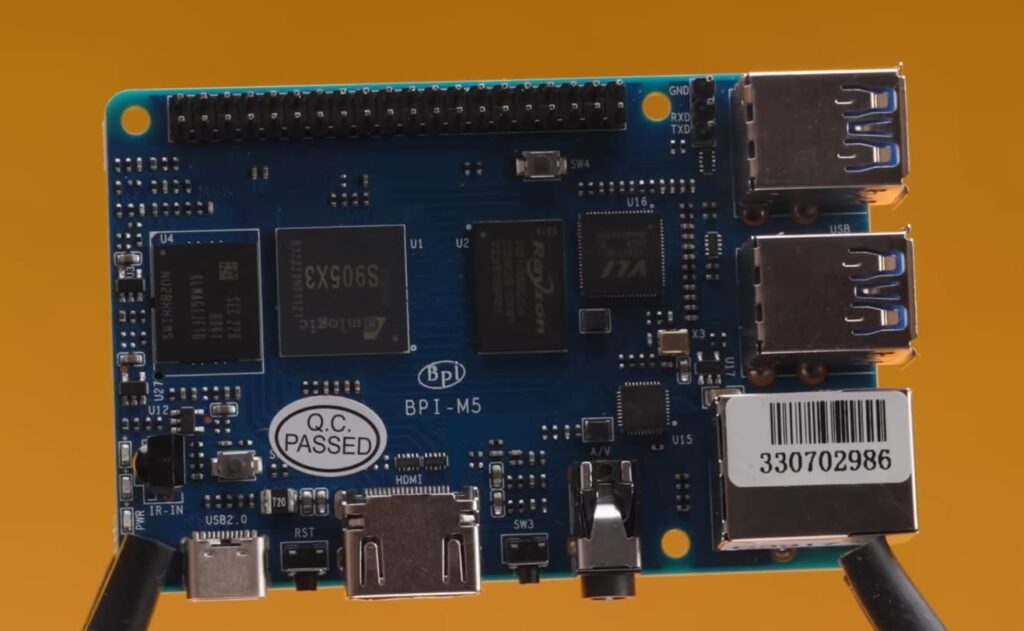

Raspberry Pi’s runaway success sparked an explosion of competing, Linux-capable SBCs, often emulating the Pi’s formula at lower price points. Boards like the Orange Pi and Banana Pi launched with similar sizes and features to Pi but retailed for $20-30. The nonprofit BeagleBoard also produces SBCs costing around $55. Most rivals undercut Pi’s pricing.

These alternatives can’t match the Raspberry Pi’s brand reach and community size. But their lower costs do sway some buyers, limiting how high Pi prices can go. Pi’s extra capabilities and maturity justify its pricing premium.

Niche Competitors

More capable SBCs pursuing specific niches also challenge Pi. Nvidia’s Jetson targets AI applications with potent graphics and machine learning acceleration but costs over $400. Asus Tinker Board goes after hackers and media center usage with extras like PCIe expansion. These specializations can fragment the market, constraining Pi’s pricing leverage.

Desktop PC Competition

Inexpensive desktop PCs have also emerged as Pi alternatives for basic computing, programming, and hobby electronics. Small form factor PCs with Windows and Linux costing $200-300 can outperform Pi in memory, storage, and software maturity. Familiar x86 ecosystem also aids adoption. This curtails Pi’s value for generic computing uses.

Supply Shortages

Raspberry Pi’s limited manufacturing capacity severely lags booming demand, which drives prices up. Without supply shortages, economies of scale could allow Pi to retail closer to BOM costs of around $35. Instead, a lack of inventory allows distributors to command higher pricing and still rapidly sell out stock. Scalpers also inflate the costs of scarce Pi boards.

Industrial & Enterprise Adoption

Growing corporate use of Pi infrastructure provides a valuable revenue stream, enabling continued Raspberry Pi innovation. But this B2B demand further strains inventory when combined with maker community purchasing. Companies are less price sensitive, however, allowing profitable premium pricing.

Despite competitors, Raspberry Pi’s capabilities and stature as the quintessential maker board make it tough to displace. But its budget appeal has declined given alternatives. Investing to expand production significantly could be an opportunity for Pi to drive costs lower in the future.

Alternatives and Cost-Benefit Analysis

With Raspberry Pi pricing on the rise, many makers are considering lower-cost single-board computer (SBC) alternatives. Let’s explore key options and weigh the pros and cons of shifting away from Pi’s ecosystem.

Arduino Boards

Arduino microcontrollers are designed primarily for electronics projects, not general computing. But Arduino boards cost just $20-40.

- Benefits: Ultra is affordable. Simple programming. Great for basic automation and robotics. Extensive hardware peripherals and sensors are available.

- Downsides: No OS support. Very limited memory and processing power. Lacks the networking/video capabilities of a Pi. Not a full computing replacement.

Overall, Arduinos complement rather than displace Raspberry Pi. Their lower cost and focus on hooking up electronics hardware make Arduino a logical addition alongside Pi in complex projects.

BeagleBoard SBCs

BeagleBoard pioneered open-source Linux SBCs even before Raspberry Pi existed. Their current BeagleBone boards retail around $55.

- Benefits: It also runs Linux. Active community support. More powerful CPU than early Pis. Capable peripherals are similar to Pi.

- Downsides: Prone to supply constraints. Minimal OS and software ecosystem currently. Less onboard memory and storage than modern Pis.

For hobbyists on a budget, BeagleBone SBCs offer an easier transition from Pi thanks to Linux compatibility. However, support infrastructure needs to catch up to Raspberry Pi.

Asus Tinker Board

At around $90, the Asus Tinker Board packs extra features.

- Benefits: Faster quad-core ARM CPU than Pi 4. 2 GB starter RAM. Gigabit LAN with PoE. Onboard wireless and Bluetooth. 16 GB eMMC flash storage included.

- Downsides: More limited OS support currently. Minimal first-party accessories/hats. Weaker community and guides versus Pi.

The Asus Tinker Board works well for applications like media centers and networking devices with extras like built-in flash storage and wireless connectivity. But Raspberry Pi’s software support is far superior.

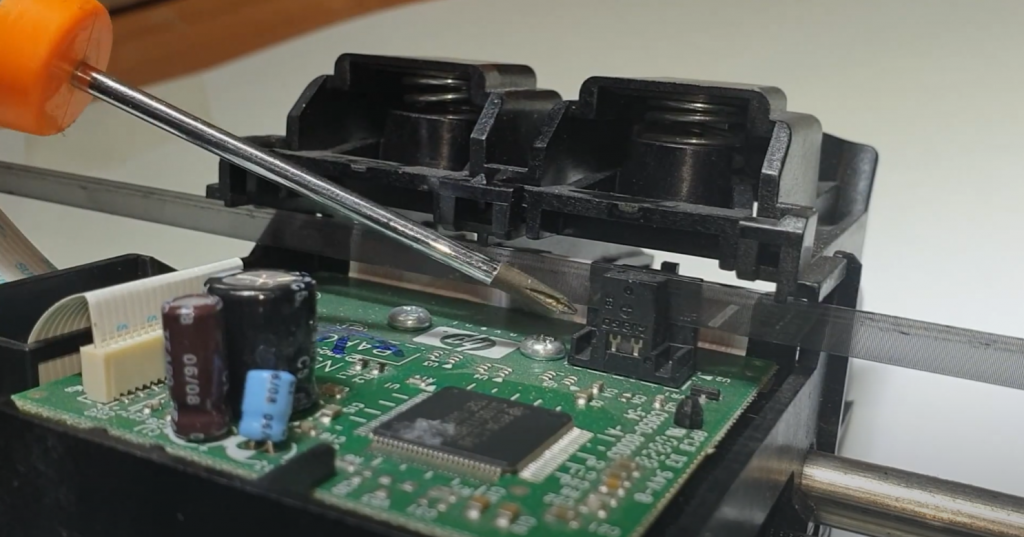

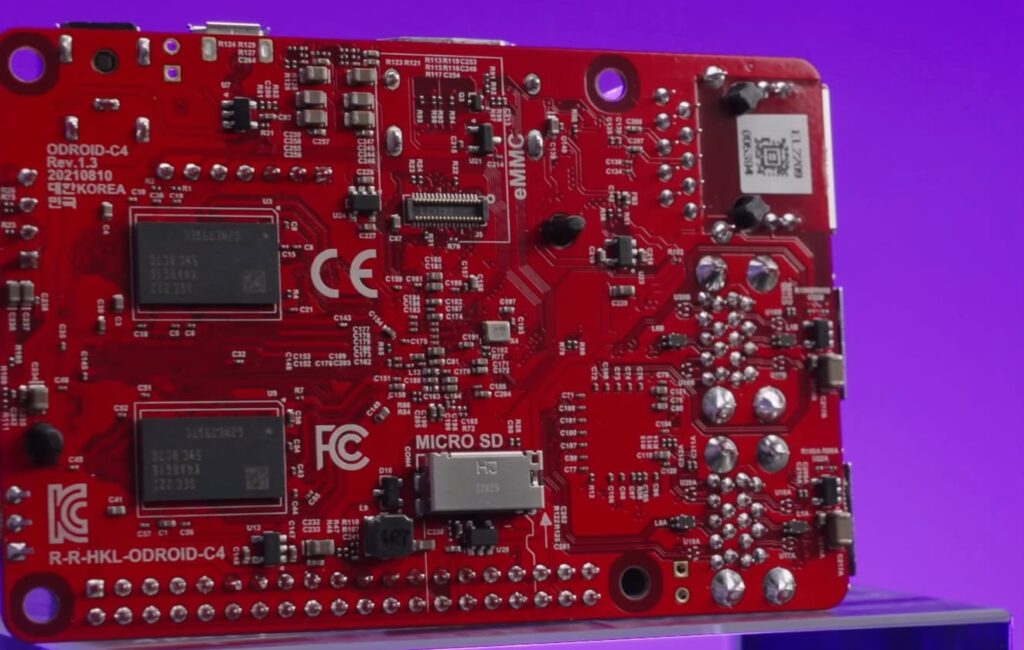

Odroid XU4

Hardkernel’s Odroid XU4 costs around $60 but outpaces Pi 4 in some specs.

- Benefits: Fast 8-core processor. USB 3.0 ports. Hardware video encoding. eMMC storage option available. Good performance for the price.

- Downsides: Less beginner-friendly than Pi. Smaller software ecosystem. They have limited in-stock availability. SSD support lacks Pi 4’s performance.

For experienced Linux users, Odroid XU4 offers fast processing at an affordable price by cutting some corners on polish and support. But Pi’s refinement makes it preferable for most educational and beginner use cases.

Cost-Benefit Analysis

Raspberry Pi alternatives can save $10-40+ in upfront costs. This savings may justify shifting away from Pi for budget-conscious hobbyists and students. However, Pi’s unmatched community resources and optimized software support tremendously increase its practical utility. Pi’s core value lies less in its hardware capabilities alone but rather in the entire ecosystem, enabling innovative projects. Alternatives with this foundation often need help to gain traction. While boards like Odroid and Asus Tinker provide capable computing for less, Raspberry Pi remains the gold standard in accessible computing for a good reason.

FAQ

What factors led to the increase in Raspberry Pi pricing over time?

The original Raspberry Pi Model B launched in 2012 at just $35. Designed as an affordable computer for promoting programming education, early Pi’s were basic circuit boards with modest specs like a 700MHz ARM processor and 256MB RAM. At first, the nonprofit Raspberry Pi Foundation subsidized costs to keep prices low. However, as demand grew exponentially, manufacturing struggled to keep up, and component supply constraints emerged. This forced Pi pricing up to $35-$40 within a couple of years. More robust capabilities were also added, increasing Pi complexity and production costs. For example, the 4GB RAM Raspberry Pi 4 Model B debuted in 2019 at $55 – a big jump from those original Pis. Overall, impossibly high demand combined with supply chain woes and more advanced computing features led to the steady Pi price hikes over the past decade.

How has demand affected Raspberry Pi pricing trends?

Raspberry Pi’s lightweight Linux platform and emphasis on learning coding made it hugely popular with tinkerers and students. The foundation underestimated how high demand would get, selling over 19 million units by 2019. They needed help to scale up manufacturing fast enough. Raspberry Pi trading also emerged, with people buying scarce Pi stock and reselling at higher prices. Attempting to keep pace, the foundation built bigger production facilities and contracted more suppliers. However, demand continues to exceed production, forcing prices up as buyers compete for limited inventory. If component supplies increased and Pi manufacturing fully caught up, economies of scale could lower costs again. But for now, endless hunger for Raspberry Pis coupled with supply limitations keeps driving prices higher.

What supply chain issues have impacted Raspberry Pi pricing?

From CPU chips to capacitors, Raspberry Pis requires hundreds of components provided through complex supply chains. COVID-related factory shutdowns and microchip shortages caused severe parts scarcity and delivery delays for all electronics. With suppliers struggling to fulfill orders, they raised prices on high-demand components like processors. Most Raspberry Pi models run Broadcom ARM chips – these increased in cost with tight supply, directly raising Pi’s bill of materials. Certain supporting components like voltage regulators also grew scarce, constraining production. While not wholly immune to supply disruptions, Raspberry Pi’s large production volumes give them some insulation compared to smaller buyers. But they still must pay inflated prices for hardware in short supply, translating to higher retail pricing.

How have technological improvements factored into rising Raspberry Pi costs?

While advancing capabilities add value, better tech also raises production expenses – contributing to Pi’s price hikes. Higher-speed processors, more RAM, and connectivity options all require more costly components and PCB real estate. Screen sharing, camera interfaces, USB 3.0 support, and WiFi 6 were just some enhancements added over the years. The latest Raspberry Pi 4 offers a 1.8GHz quad-core CPU, up to 8GB RAM, gigabit ethernet, dual monitor support, and ample I/O – lightyears past the original Model B. More computing power and features justify somewhat higher pricing but also make Pis pricier to build. The foundation reinvests profits into better technology, but those improvements come at a cost.

How does inflation affect the rising cost of Raspberry Pis?

Even if supply stabilized and capabilities remained static, inflationary pressures would still have pushed Raspberry Pi prices higher. Cumulative inflation from 2012 to 2022 exceeded 20% in the US and UK All business costs, including labor, utilities, transport, and supplies, grew significantly more expensive. Every supplier along Pi’s manufacturing pipeline likely raised their rates to offset inflation. So, the total cost of parts and production for finished Pis climbed higher. These cascading increases eventually flow through to the end retail pricing, independent of other pricing factors. Inflation’s sustained rise guarantees Raspberry Pi prices will continue trending up, even if other headwinds like shortages are solved. The days of $35 Pis have been left behind.

Can Raspberry Pi lower prices significantly again?

Given strong demand and supply limitations, it seems unlikely Pi will return to $35 pricing anytime soon without sacrifices. If demand softened, they could cut costs via reduced manufacturing. Producing Pis at huge volumes also lowers per-unit expenses. Partnering with even larger contract manufacturers like Foxconn could squeeze out savings on an enormous scale. Substituting lower-cost components is risky, though, as it could diminish Pi’s versatile capabilities. Unless demand shrinks or massive supply materializes, the core pricing pressure remains. But Pi’s value also depends on usage – for industrial controls or productivity, current prices are highly affordable. Only basic education or hobby uses have Pis lost cost competitiveness.

How has the US-China trade war contributed to increased prices for Raspberry Pi?

Ongoing trade tensions between the US and China have raised tariffs on imported Chinese electronics like the Raspberry Pi. In 2018, the US applied 25% import duties on around $200 billion worth of Chinese goods, including circuit boards and other components used to manufacture Pis. These tariffs have increased Raspberry Pi’s cost to produce, directly raising the pricing for American buyers.

While the Raspberry Pi Foundation manages to avoid the harshest trade penalties due to its educational nonprofit status, the SBC is still subject to elevated tariffs of up to 12% in the US market. With most Pi production and the supply chain centered in China, there is no easy way to avoid the trade war’s impact on pricing. Any increase in input costs inevitably gets passed along to consumers. And new rounds of tariffs continue to be enacted, promising continually rising expenses for Pi imports until trade relations improve.

How does Raspberry Pi pricing differ across global markets?

Raspberry Pi pricing varies across international regions depending on factors like competitive pricing, tariffs, taxes, and currency differences. Within the EU common market, Pi pricing is generally consistent. The basic Raspberry Pi 4 Model B sells for around €39. In the UK specifically, VAT adds about 20% to €35 base pricing, making the Pi 4 Model B cost around £43.

In the US, most main online retailers sell the Raspberry Pi 4 Model B for $55 to $60 as of 2023. That represents a significant increase from the ~$35 USD price point of early Pi models. Tariffs on Chinese electronics explain part of this difference. And the strong US dollar versus the British pound also contributes to higher perceived costs for Americans.

In developing markets like India and South America, official distributors are allowed to set retail pricing appropriate for regional income levels. This enables lower price points to improve local affordability. But availability is much spottier in emerging markets. On a global scale, the current price of a Raspberry Pi 4 Model B ranges from around $35 to $65 USD, depending on the specific market.

Related Video: I Can Save You Money! – Raspberry Pi Alternatives

Final Words

Raspberry Pi’s rising prices can be chalked up to a perfect storm of high demand, component shortages, more advanced capabilities, supply chain issues, and general inflationary pressures. What began as an affordable way to promote computer science education soon became a widely popular phenomenon that couldn’t scale fast enough to meet demand. Add in more performance-driven features, and costs climb higher. While still useful for learning coding and electronics, Pi’s value at 3-4X the original $35 price point has undoubtedly decreased. For many, the magic of Raspberry Pi’s low barrier to entry has faded as pricing exceeded expectations. Nonetheless, Pi remains a catalyst for technology education and innovation at reasonable costs.